If you search for a waffle weave blanket on Amazon, summer styles at Target or a dishwasher at Best Buy, there’s a good chance that the first search results you’ll see will be sponsored ads. You might also get a promotional banner at the top of the page and a nicely branded video after a scroll or two. That’s retail media at work: advertising tailored to your shopping mood.

Retail media networks are all about seizing the moment, so let’s jump right in.

What are retail media networks?

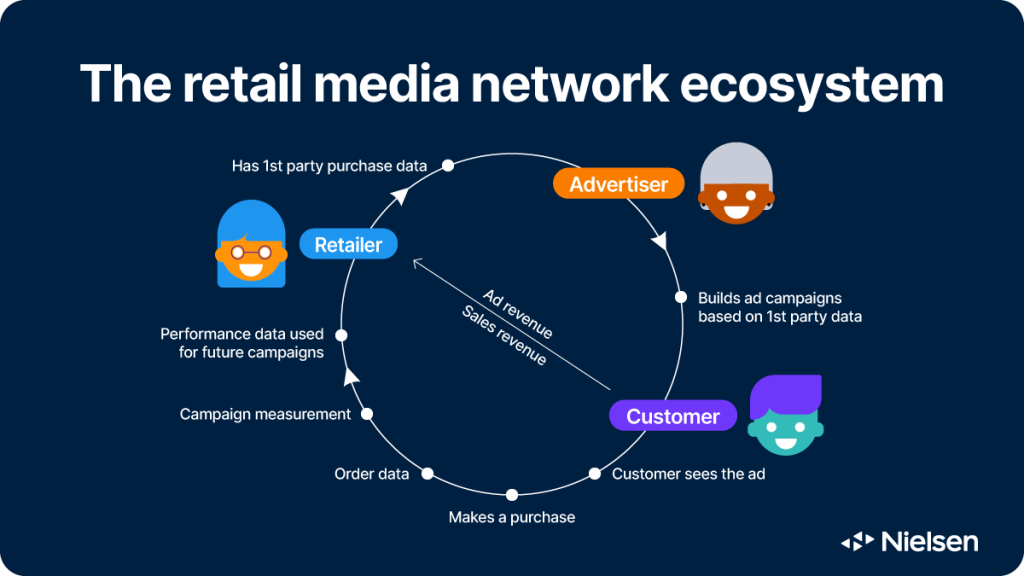

According to eMarketer, a retail media network is “an asset owned and operated by a retailer that publishes advertisements, or a third-party publisher with ads that leverage a retailer’s first-party shopper data.”

Retailers collect data about your shopping behavior and use it to personalize your experience, including the ads you see. They can use your shopping profile—and anything else they learn about you from your interactions with them—to influence the ads you see (or hear) on social media, CTV and digital radio. And on top of that, retail media networks are able to seamlessly tie impressions to sales on a platform, something that was not widely available before.

How did retail media start?

For most industry observers, the birth of retail media was the release of Amazon’s programmatic advertising solution, Amazon Ads Platform (AAP), in 2012.

Learning from people’s shopping behavior, presenting them with relevant offers and reaching them at the point of purchase wasn’t exactly a new idea. Direct to consumer (DTC) brands, and brands with loyalty programs before them, had long used first-party shopper data to target consumers. And grocery chains and big box retailers have always featured in-store displays and promotions. But the scale and automation offered by Amazon were unprecedented.

From about $600 million that first year to $45 billion in 2023, the rise of Amazon’s ad business has been meteoric—and that was before the launch of its ad-supported Prime Video tier in early 2024. Over time, its success has drawn hundreds of other retailers into the media business. Walmart, Target, Kroger, Instacart, The Home Depot and others are fueling a sector that’s growing at twice the pace of social media (16.3% vs. 8.7% in 2023, according to the IAB) and is expected to overtake linear TV over the next couple of years.

Why is there so much enthusiasm?

Retail media networks are a win-win-win for retailers, brands and consumers.

For large retailers, scale and specialized audiences can represent a whole new revenue stream—with much stronger margins than their core retail business to boot. BCG estimates retail media margins in the 70% to 90% range for onsite ads and 20% to 40% for offsite ads, at a time when inflation, supply-chain issues and other macroeconomic conditions are putting intense pressure on retailers’ standard lines of business.

For brands, retail media networks offer a chance to create audiences based on recent shopping behavior and reach those audiences with finely tuned messages at a time when they’re likely to be more receptive to those messages. Relevant ads to the right people and in the right context is a great combination, especially now that third-party cookies and other legacy identifiers are (slowly) being deprecated. And retail media networks aren’t limited to lower-funnel campaigns either. No wonder 70% of global marketers say retail media networks are more important to their 2024 media plan than the previous year.

Consumers win too because they don’t see ads for snow jackets or cruises to Alaska when they’re shopping for board shorts and snorkeling lessons in Hawaii.

Important media mix considerations

While retail media is undoubtedly an exciting new channel for advertisers, you should only invest in it for the right reasons. Is the audience worth the higher cost? Can you reach not just existing customers but also attractive new prospects? How does it fit with the rest of your media mix? Do you have consistent reporting to compare performance across other retail networks?

While retail media is undoubtedly an exciting new channel for advertisers, you should only invest in it for the right reasons.

Too many marketers add retail media to their mix out of fear of missing out or out of concern that retailers might retaliate with inferior ‘shelf’ placement if they don’t buy advertising on the platform—something Forrester described as a form of hidden tax. Some advertisers are also under the impression that retail media networks solve the attribution puzzle with their closed-loop measurement because they’re so close to the moment of purchase. But last touch attribution isn’t any more reliable just because it’s on retail media.

Treating retail media like just another channel

With hundreds of options on the market, over two-thirds of ad buyers (69%) are overwhelmed by the complexity of the current retail media buying process. While there are calls for standardization, it’s still largely siloed from other media transactions—to say nothing of the process of reconciling retail media buying with the rest of the media ecosystem. Four in ten ad buyers have only enough bandwidth to work with at most three retail media networks at a time.

In a sign that retail media is maturing, the IAB just proposed new standards in Europe to tear down silos between players and harmonize their offerings. At Nielsen, we think that’s a good first step. Brands need consistent, transparent and outcomes-minded measurement across all of their media partners to get a full picture and build confidence in their overall media spend.

Brands need consistent, transparent, outcomes-minded metrics across all their media partners to get a full picture and build confidence in their overall media spend.

That confidence factor is essential to unlocking real spend. While advertisers are fine to shift some budget because of the measurable sales lift, there’s still uncertainty around the incremental value retail media can provide. The best thing that can happen to retail media is to be treated as just any other channel. And moving real budgets at scale will require comparability across all measurement metrics.

Retail media’s emerging opportunities

This is the right time for standards. Online and offline retail media are merging thanks to the rise of digital “smart” shelves, in-store mobile experiences and loyalty programs that connect in-store and online data to build holistic consumer profiles. And retail media is already growing beyond lower-funnel activities and even retail, for that matter, with market leaders like Lyft, Marriott and Chase showing the way. It’s also crossing over into the CTV space, with trailblazing partnerships between Instacart and Roku, Walmart and Peacock, and of course Amazon and Prime Video.

Nielsen’s Need to Know reviews the fundamentals of audience measurement and demystifies the media industry’s hottest topics. Read every article here.